The first quarter of 2021 was certainly an interesting time to be an investor. After a steady start to the year, everything changed in mid-February.

Perhaps it was the prospects for the end of the pandemic, the potential of Biden’s economic plans, rising interest rates or something else entirely. What we do know is that in mid-February the markets turned more volatile, and the market sectors that led the market one day lagged the next.

The challenge for long-term investors is to not be swayed by short-term fluctuations.

When the dust settled, the first quarter of 2021 turned out to be a pretty good time to be a stock investor. The S&P 500 was up 6%, though there was a very wide gap between the highest performing sectors (financial +18%, small caps +15%) and the laggards (healthcare, technology, utilities, and international stocks all up between 3% and 4%).

Unfortunately, the same cannot be said for bond investors. The average core bond fund lost 3.3% for the quarter as interest rates rose. It was even worse for long-term bonds, which lost between 10% and 20% for the quarter.

It wasn’t all bad in the bond market. Convertible bonds (+1.5%), high yield bonds (+1%), bank loan bonds (+1.5%) and mortgage bonds (+0.5%), all managed to eke out small gains for the quarter.

When trying to divine the future of the stock market I often look at metrics such as price-earnings ratio, market sentiment or market volatility. Not every market lends itself to such tidy quantitative measures, though economists do their best to model every scenario, which is, of course, impossible.

As I look at the market today, I see a variety of competing positive and negative influences.

On the plus side are the $1.9 trillion COVID relief package, the potential for a very large infrastructure plan, the eventual end of the pandemic, and the steepening of the yield curve.

COVID Relief & Infrastructure: On the face of it, these should be huge positives for stocks. Consumer spending is one of the most important pillars for economic growth. COVID relief has and will continue to support consumer spending. Should an infrastructure bill pass, the government will be creating as many as 19 million jobs, which will further support the economy.

The one caveat with respect to government spending is that it could lead to higher inflation. A little inflation is a good thing, as long as it doesn’t get out of control. With rates as low as they are, we are still a long way from inflation becoming a problem. In my estimation we are years away from that, if it happens at all.

End of the Pandemic: Although the pandemic isn’t over, we may be at the beginning of the end. I just had my first dose of vaccine. Have you had yours? It would be difficult to argue that the end of the pandemic would be anything but good for the economy, though which companies will do well post pandemic will likely not be the same as the ones that thrived during the pandemic.

Steepening yield curve: You may recall at the start of 2019 I was worried about the inverted yield curve. Inverted yield curves are often, though not always, precursors to bear markets.

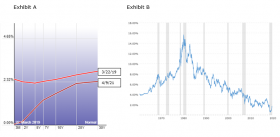

Compare the two yield curves on the chart above in exhibit A. Along with the recent rise in interest rates, the yield curve has also become positive sloping. A positive sloping yield curve is a harbinger of positive economic growth.

The negative influences are higher interest rates and the prospect of higher taxes.

Higher Interest Rates: Higher interest rates are negatively correlated to stock market valuations. Higher rates lead to lower valuations and vice versa. The 10-year Treasury Bond yield has risen over 1.2% from last August to the end of March, with most of that rise happening this year. So, we should start worrying, right?

Not so fast.

What also matters is the absolute rate. See exhibit B, above. After having risen 1.2%, the 10-year Treasury Bond rate is at about 1.7%. Even after the recent rise, the 10-year T-bond is still lower than all 10-year yields over the past 50 years, with the exception of a few brief periods in 2012, 2016 and 2020. As with inflation, we have a long way to go before higher treasure yields will become a problem.

Higher Taxes: The government has to find a way pay for the COVID relief bill as well as the expected infrastructure plan. Higher corporate and individual taxes are among the likely choices to foot the bill. While I can make a positive case for inflation and interest rates being higher than that they are today, I cannot say the same with regard to taxes.

Higher taxes, though perhaps necessary, will universally be viewed as a negative with respect to stock valuations.

So, we have some good influences, some bad influences, and some that look bad but aren’t really. When I put it all together and weigh the evidence, I see more positives than negatives. I am bullish that stocks will be higher in 2021.

Tempo Financial Advisors’ 1st Quarter Investment Performance

Three out of Tempo’s four investment strategies beat their respective benchmarks, though only one was able to generate a positive return.

Tempo Lifestyle returns were between +4% and +6% for the quarter. These results were between 1% and 1.5% better than benchmarks. Two primary reasons explain our outperformance.

First, as you may recall from previous newsletters, we always have exposure to both small and mid-cap U.S. equities. When large caps outperform we have trouble keeping up. That had been the case for quite a few years. But since the 4th quarter of 2020 that has changed as small and mid-cap stocks have outperformed. Returns for the first quarter for large caps, mid caps, and small caps were 6%, 13% and 15%, respectively.

Second is our positioning within bonds and our “bond proxies” (aka alternatives). As you now know, core bonds were down 3.3% for the quarter (some bonds were down a lot more). While not every bond fund or alternative fund we own was up for the quarter, the majority were and as a whole we were able to eke out a small gain from these segments of Lifestyle accounts.

Tempo Dynamic Income had the best quarter relative to its benchmark, which it beat by 2.5%. Unfortunately, the benchmark lost 3%, which means that Dynamic Income lost only 0.6%.

I do hate losing money, and I know you do, too. Still, anytime we can outperform the benchmark by 2.5% I am pretty satisfied.

Tempo Diversified Income had a similar result. A negative return for the quarter of 1.2%, which was nearly 2% better than benchmarks.

Both Dynamic Income and Diversified Income have started the second quarter on positive notes. Dynamic Income is back in the black for the year and Diversified Income is getting close.

The one underperformer for the quarter was Dynamic Growth. More than any of our other strategies, Dynamic Growth was adversely affected when the market switched gears in mid-February. Prior to then, our positions in technology, emerging markets, international small caps, and emerging market bonds had been doing quite well and portfolios were up over 5%.

When the shift in the market occurred, our positions were suddenly out of favor. The result was a loss of 0.9% for the quarter, which was 4% worse than its benchmark.

Dynamic Growth accounts have been rebalanced and the second quarter has begun on a positive note. As with Dynamic Income, accounts are now positive year-to-date.

Reminder

Please contact us if there has been a change in your financial circumstances that would warrant a fresh perspective on your portfolio.

Daniel J. Traub